Navigating inflation and the threat of recession

Article written by Mike Campbell, Source: WARC Best Practice, September 2022

Takeaways

- Where they have the funds available, brands should continue to invest in advertising. Media deflation resulting from reduced competition means their media spend becomes both more efficient and more effective.

- With fewer brands advertising, it is possible for investor brands to increase their share of voice and in this way enhance existing and build new memory structures in the minds of current and prospective customers.

- Brands that have performed strongest after a recession are those prepared to innovate during it. This can be in terms of new product development, service offerings, advertising messaging, and bringing about digital transformation for product and service delivery.

As a reminder, a recession – technically – is a back-to-back decline in gross domestic product (GDP) in two successive quarters.

While economies may not be formally in a recession yet, many people are effectively experiencing the recession already at a household level, driven principally by sky-high energy prices and galloping inflation. This has led to changing consumer behaviour, with many families trading down from premium to basic products, from branded to private label.

Nations divided.

In many major economies around the world there is a very wide and growing disparity of wealth. Past recessions – including in 2008–10, in the wake of the banking crisis – show that while some families trade down, the more comfortably off may choose to consume less conspicuously but still treat themselves at home and increase spending on luxury and premium items.

Indeed, although economies may go into recession, fine-grained analysis of previous economic downturns clearly shows that different groups in society have very different experiences of recessionary times. This makes it more challenging to predict the impact of the looming recession on different sectors of the economy.

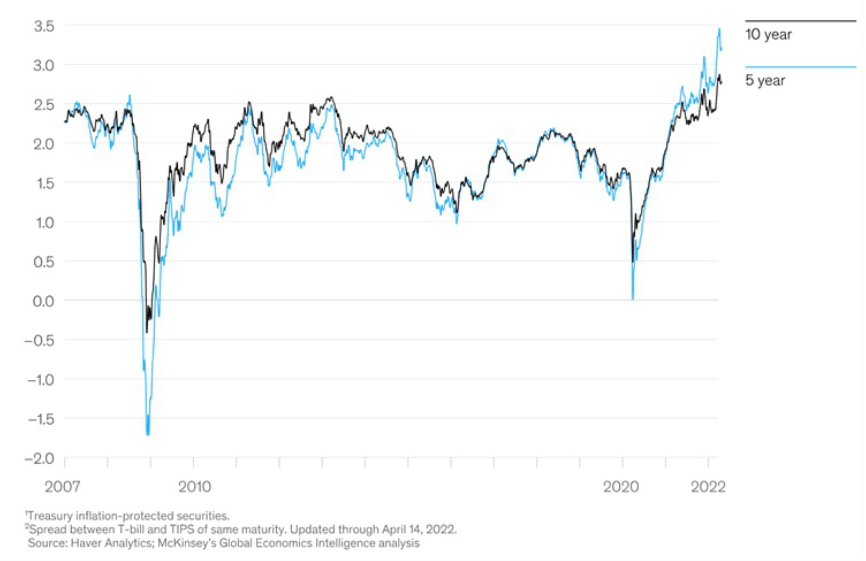

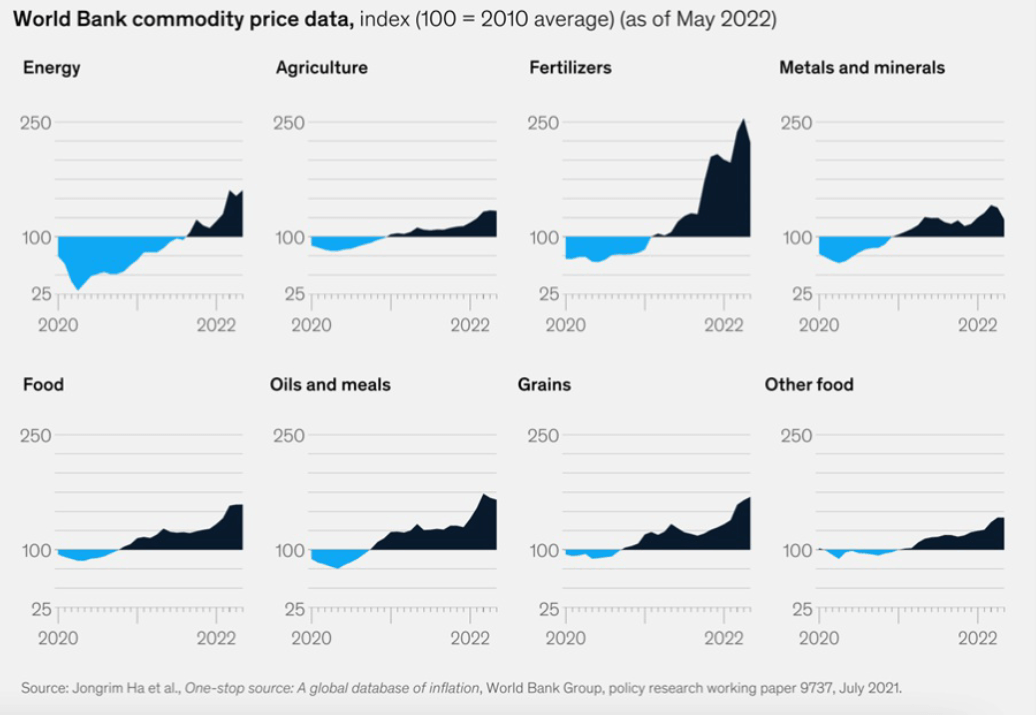

The following two charts from recent McKinsey reports highlight two of the principal drivers of the forthcoming recession – unprecedented projections for inflation (Figure 1) and soaring commodity prices across many different categories (Figure 2).

Figure 1: Projections in inflation

Figure 2: Prices for commodities are higher across the board

Opportunities for brands

What is clear is that recessions have a habit of weeding out brands that are in poor financial shape, where even a small decrease in demand is all that it takes for a business to become economically unviable. In the wake of the 2008 financial crisis, for instance, high streets around the world saw many, once-familiar, much-loved retail brands disappear.

Decreased demand is one cause of failure during a recession. Brands deciding to ‘go dark’ and cut or eliminate marketing investment are also more likely to fail during or come out of an economic downturn.

Cutting ad spend in a recession is a false economy, indeed, and many brands have found time and again that sustained investment at this time delivers disproportionate ROI particularly as competitors cut back.

In the vast majority of cases, brands should continue to invest, as this often leads to a significant increase in their excess share of voice (ESOV), enabling them to gain a share of the market in the long term. Sustained investment is cheaper and more efficient, too, as less competition for media leads to media deflation.

Investor brands can buy more for less, reinforce existing memory structures, and drive sales during the recession. And once it’s over, they’re in a much stronger position to build on this position of dominance than they were before.

Focus on long-term over short-term

Sustained or increased ad spend during a recession demands judgement; it’s not a case of investment in any media available, but rather a bias towards media that deliver long-term brand-building benefits. Over the last 20 years, however, many brands that have continued to invest during recessions have chosen to spend most on performance or lower-funnel digital media that drive immediate response and short-term sales. Rigorous analysis of this type of investment, however, shows that this media strategy is often misguided. Rather than piling funds into search and PPC, brands would be better off investing in media – such as TV, radio, and out-of-home – that can deliver mass audiences at scale.

See Figure 3:

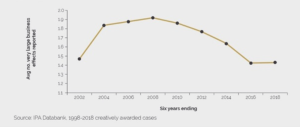

One of the reasons why brands have overinvested in lower-funnel performance media is that they mistakenly believe it is more efficient than it actually is, particularly during times of recession. This is because they use flawed, digital attribution models (first- or last-click, say) which overstate the contribution of performance media to overall marketing effectiveness. Indeed, overdependence on both performance media and the models designed to measure their impact is one of the reasons why media ROI has fallen over the past 10–15 years, as Les Binet and Peter Field have shown repeatedly in their analyses.5 The decline in media efficiency is shown in Figure 4, below. This has to some extent been fuelled by companies misinterpreting digital attribution models and thinking the performance of digital media is more efficient than it actually is.

Figure 4. The declining effectiveness of creatively awarded campaigns

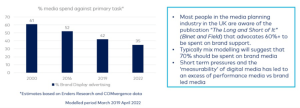

It is not uncommon for leading brands to fall out of balance between creating demand (through long-term brand building) and harvesting that demand (through short-term sales activation and performance media). Twenty years ago, brands typically put more than 60% of their ad spend behind the primary task of brand building on mass reach broadcast media channels. Today only one-third of ad spend is focused on brand building. As a result, ROI has declined markedly in this period. This is reflected in both repeated studies from the Institute of Practitioners in Advertising (IPA) as well in the ROI database from Ebiquity’s marketing effectiveness team. This is shown in Figure 5, below.

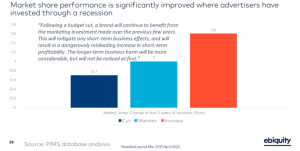

What’s more, our own modelling demonstrates that high-reach channels – particularly TV (or AV more broadly) and radio and press – have better, long-term impacts. Digital display and PPC are incapable of driving long-term impacts. Figure 6 shows the overall impact of investing through a recession. The data comes from the PIMS database, the largest and most comprehensive analysis of its kind.

Those brands that maintain spending at pre-recession levels maintain market share in the first two years of recovery. Those that cut spend see their market share shrink by 30%, while those that increase spend can grow their market share by as much as 60%. Investing through a recession is a highly efficient way of securing both excess share of voice and excess share of the market, provided brands choose to advertise with the right messages in the right channels.

How brands can protect themselves and grow coming out of a recession. Based on a comprehensive analysis of the impact of different paths taken by many different brands in historical recessions, there are six parts of one strategy that advertisers should follow to survive during a recession and thrive on the other side of one.

How brands can protect themselves and grow coming out of a recession

Figure 7. Ebiquity’s guidelines for marketing spend and analysis during a recession

- Don’t go dark – Where they have the funds available, we recommend that brands continue to invest in advertising during a recession. Because of inevitable media deflation thanks to reduced competition for available media, their media spend during the period of economic decline becomes both more efficient and more effective.

- Seize the opportunity to increase your share of voice – With fewer brands advertising, it is possible for investor brands to increase their share of voice and in this way enhance existing and build new memory structures in the minds of current and prospective customers. Reduced competition for media combined with media deflation is a recipe for media efficiency. Brands can do more with less.

- Invest in the right content – It is crucial that the content advertisers choose to deploy during a recession is both appealing and contextually appropriate. Although, as we’ve noted, there is an ever-growing disparity in relative wealth between those affected by the recession and those lucky enough not to be, this will be no time for grandstanding or smugness. Likewise, purpose-led advertising will likely take a back seat, in favour of more rational, direct commercial communication.

- Review your channel investments – As Binet and Field have shown, brands need to balance long-term brand building with short-term activation if they are to sustain and grow their brands. This is particularly true during a Figure 7. Ebiquity’s guidelines for marketing spend and analysis during a recession. Led astray by the false promises of digital attribution, in previous, recent recessions, brands have overinvested in lower-funnel, performance media channels and underinvested in higher-funnel, brand-building channels. Advertisers should avoid repeating this mistake in the imminent recession.

- Innovate in terms of products, services, messages, and digitalisation – Times of crisis are also times of opportunity, and brands that have performed strongest after a recession are those prepared to innovate during it. This can be in terms of new product development, service offerings, advertising messaging, and bringing about digital transformation for product and service delivery. This approach helped many brands to innovate and prosper in the wake of the COVID recession. Running multiple, iterative, quick-and-dirty A/B tests can enable brands to innovate at pace.

- Measure and monitor effectiveness – There’s no point in following any of these strategies if brands aren’t also prepared to measure and monitor the effectiveness of their investments. This is perhaps particularly true of activity undertaken during a recession. When there’s a squeeze on margins across the supply chain, all functions and departments need to justify spending in tough economic times like never before. Those brands that invest, measure, and monitor effectiveness – those CMOs who are able to demonstrate ROI to their CFOs – can help their leadership teams understand that marketing investment is better thought of as capital and not operational expenditure.

It’s vital that brands get their measurement framework right in recessionary times to fuel the right investment decisions. Long-term effects can only be secured if you have the right messaging in the right channels. Measuring and monitoring effectiveness means having the right analytical techniques in place to get the right answers when comparing – say – the impact of a brand TV campaign with a performance, PPC campaign.

In summary

Despite the tough economic climate ahead, sustaining marketing investment will be the right approach for many brands. Marketers should resist the lure of overinvesting in performance media while at the same time underinvesting in brand-building media. Focusing on lower-funnel over higher-funnel activities fundamentally weakens brands and does more harm than good. By following the six principles outlined in this article, brands can weather the coming storm and emerge stronger on the other side.