New research – Oz advertising spend intention for the second half of 2020

Half of Aussie Marketers waiting for better times before committing budget & shift to online set to accelerate.

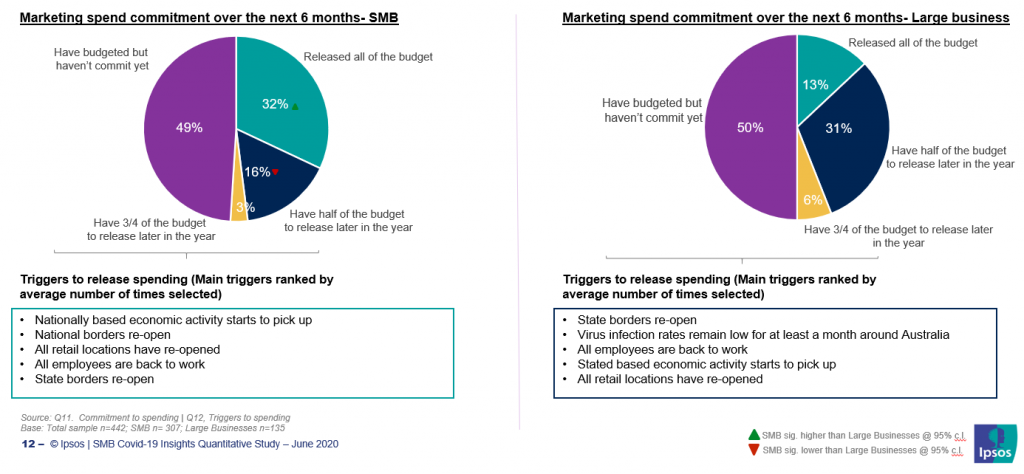

68% OF SMBs[1] and 87% of large businesses[2] still have marketing related spending budgeted for the next six months according to new research commissioned by AANA and IPSOS. Most businesses say that releasing the spending will depend on when retail locations, national and state borders re-open and when employees re-start regular work patterns. As a result, 50% of both large & small businesses have marketing budget sitting on the sides lines waiting to be committed at some point in the near future.

A total of 442 small, medium, and large businesses were asked about the combined impact of the bushfires and COVID-19 have had on marketing spend and what their media preference would be in the next six months.

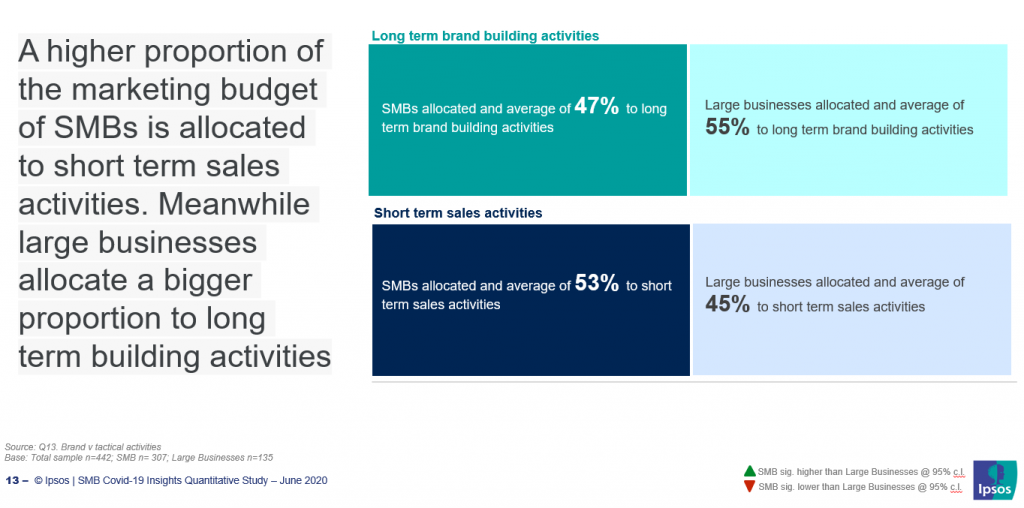

Also of note is that large businesses are more committed to investing their marketing spend behind long term brand building which is a clear demonstration that Peter Field’s messaging to marketers is getting through with the balance between long & short term almost at the recommended 60/40 split. Alternatively, SMB’s have a much clearer priority towards short term sales focus.

The research found that the trend towards online channels will continue and it’s share of total media spend will accelerate as a result of the current economic crisis. Consumer uncertainty caused by new lockdowns and COVID hotspots will likely only exacerbate this as the population becomes less mobile. As a result, most Australian businesses are more likely to use and continue to use online paid media over traditional media.

Business resilience

Impact on business revenue in the first half of 2020 has been significant, with 85% of SMBs and 76% of large businesses claiming an average decrease of 42% and 27% respectively, compared to same period last year. The research found that SMBs have been more likely than larger business in having to close or stop operating temporarily as a result of the current crisis but the SMBs that remained open seem to be more resilient than larger businesses. 28% of SMBs have had no change to their business operations whatsoever while only 11% of larger businesses fell into this category. 13% of larger businesses are fully open and have had an increase in their business, while only 5% of SMBs experienced an increase.

Impact on employment

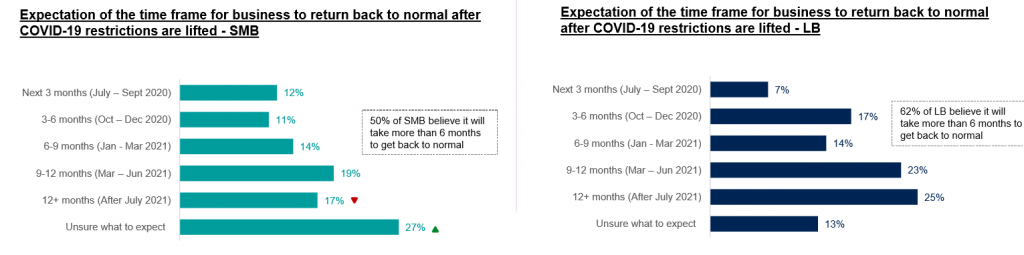

Most businesses are unsure or now see business being negatively impacted for an extended time period (9+months). Where larger business has tackled the crisis by asking staff to take annual or long service leave (50%) most SMBs’ (47%) staff have been put on reduced hours to manage the rolling restrictions. Larger businesses have also shed casual staff at a greater rate (40%) than SMBs (18%).

The Challenge

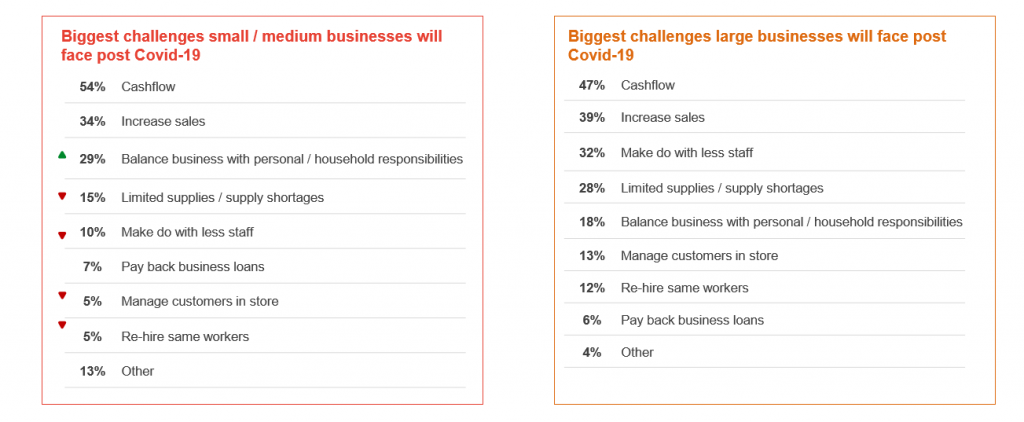

The no 1 challenge concerning all businesses is cashflow and with concerns about how to increase sales a close second. Larger businesses are more likely to face challenges trying to make do with less staff, managing limited supplies and customers, while SMBs are more likely to find challenging balancing business with personal/ household responsibilities.